How to Create a Loan Program?

This article summarizes how System Admin. user role can create, copy, and manage programs.

NOTE: DSCR is not a loan type within the system. It is recommended that DSCR is included in the name of the program when creating a program. If you wish to bypass the loan limits functionality within the system the "Program Type" field should be set to Other. This applies to any program you wish to bypass not just DSCR

Step-by-step guide

-

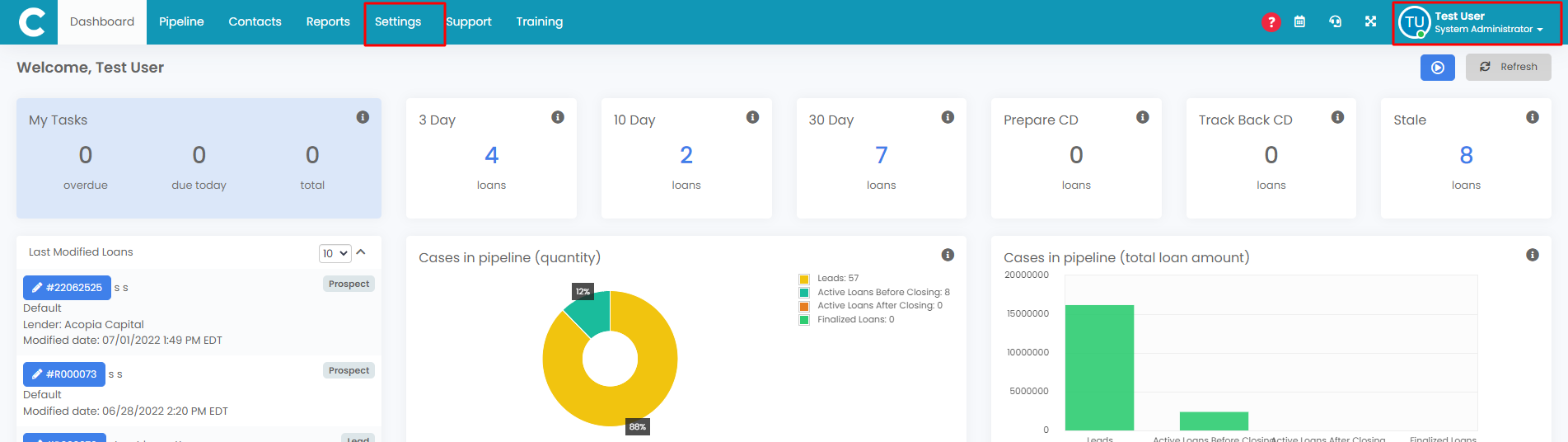

Login to LendingPad as a system administrator and click Settings in the top color bar.

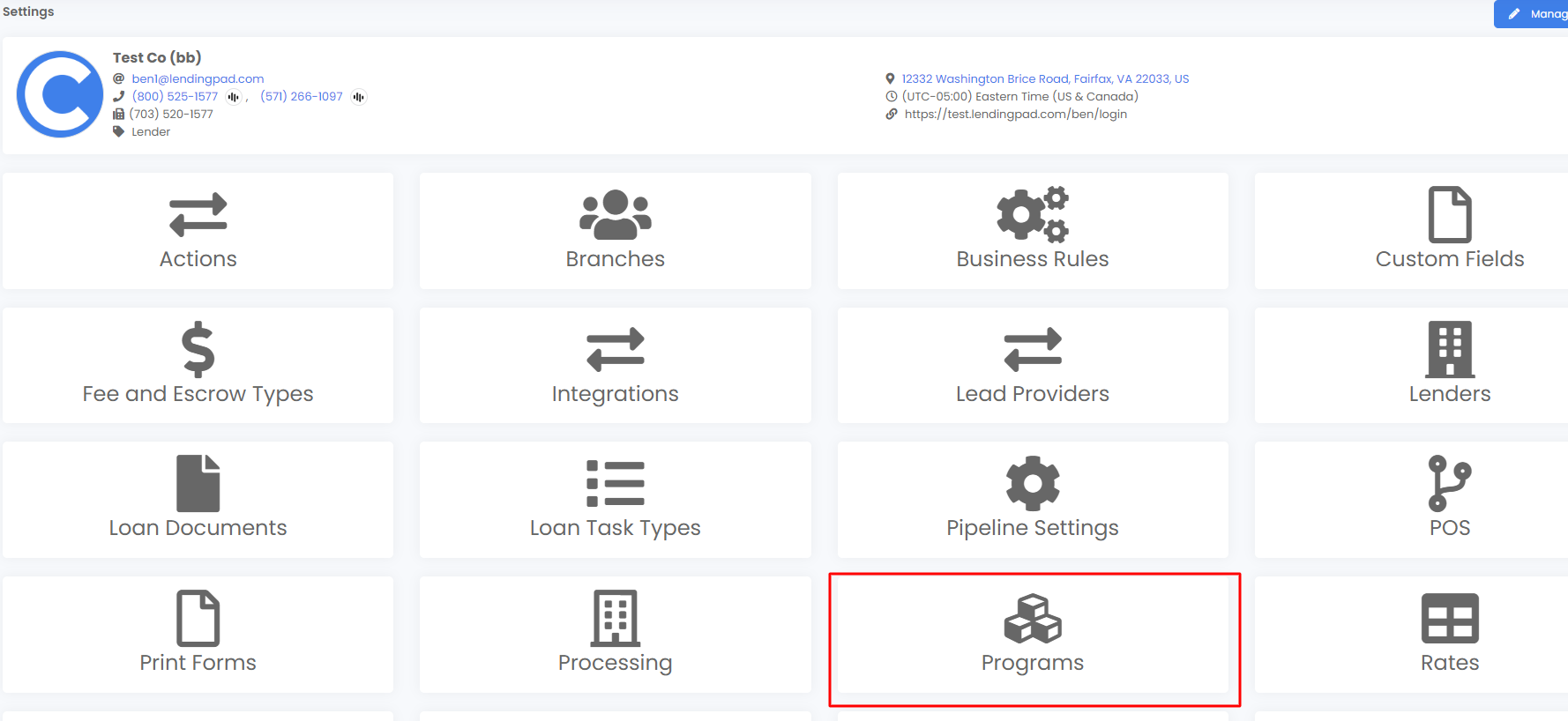

2. Click on “Programs”.

3. From here can edit current programs in the list, create a new program, copy an existing program and alter parameters, or rearrange the order of the programs that appear within each loan file.

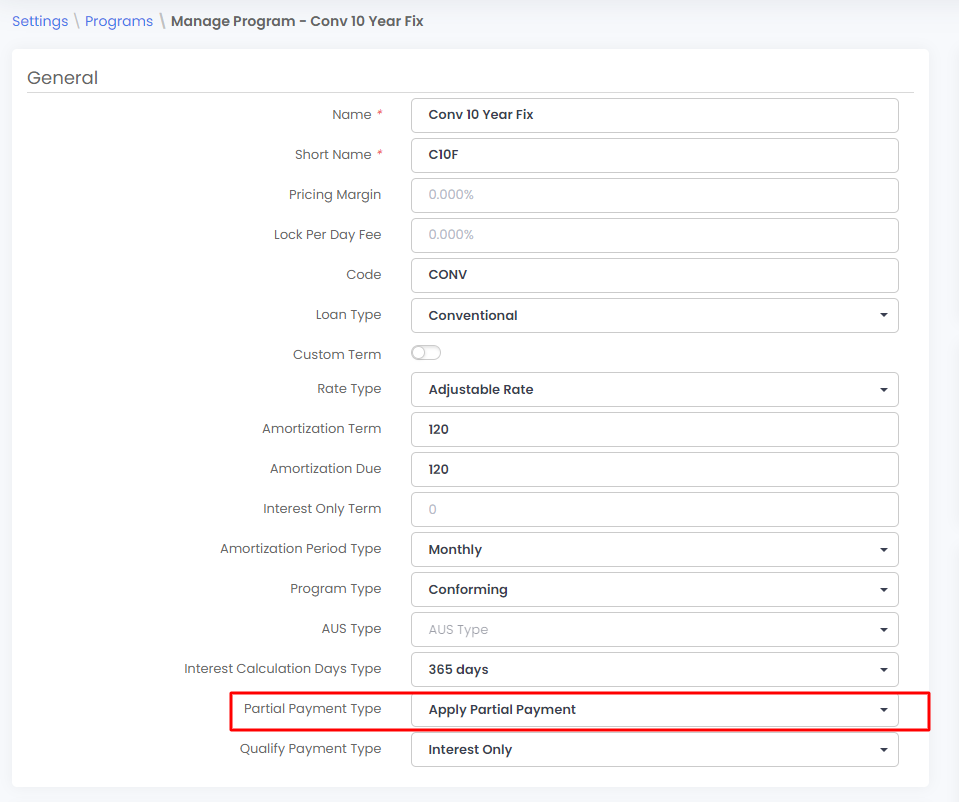

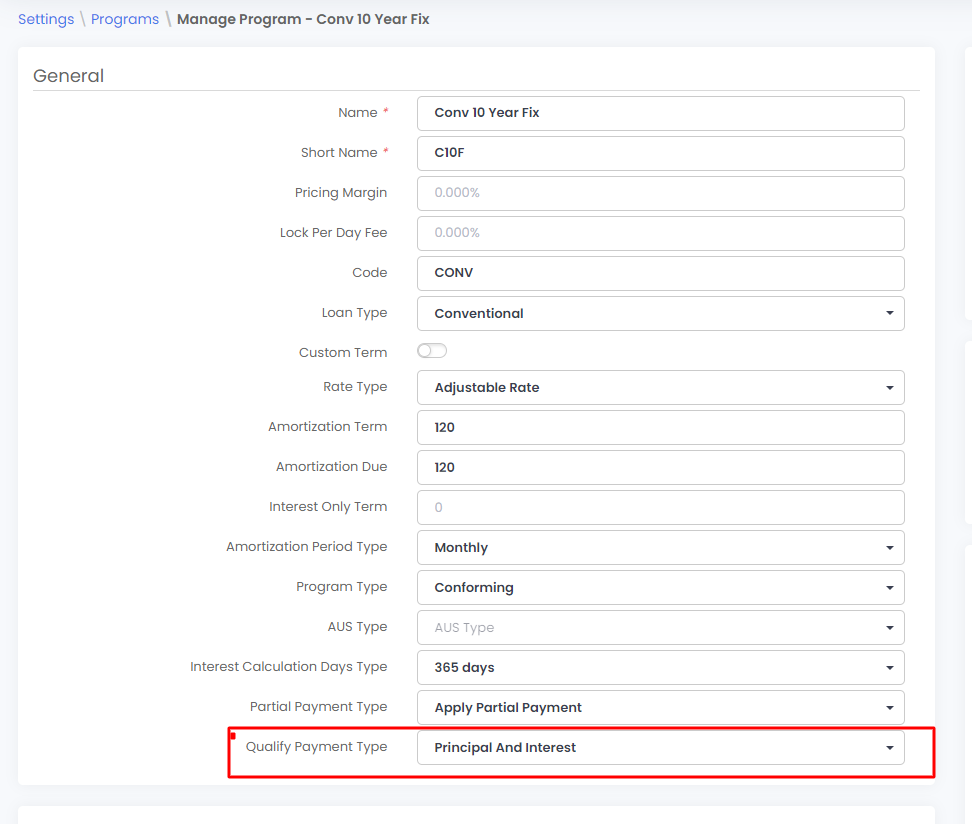

5. Input all the required information and click on “Save Changes”. Please note: For loans with an IO term the amortization will be calculated based on the Amortization term field + IO field to give a total amortization. Please setup the program accordingly to get a total that aligns with your program's total amortization period.

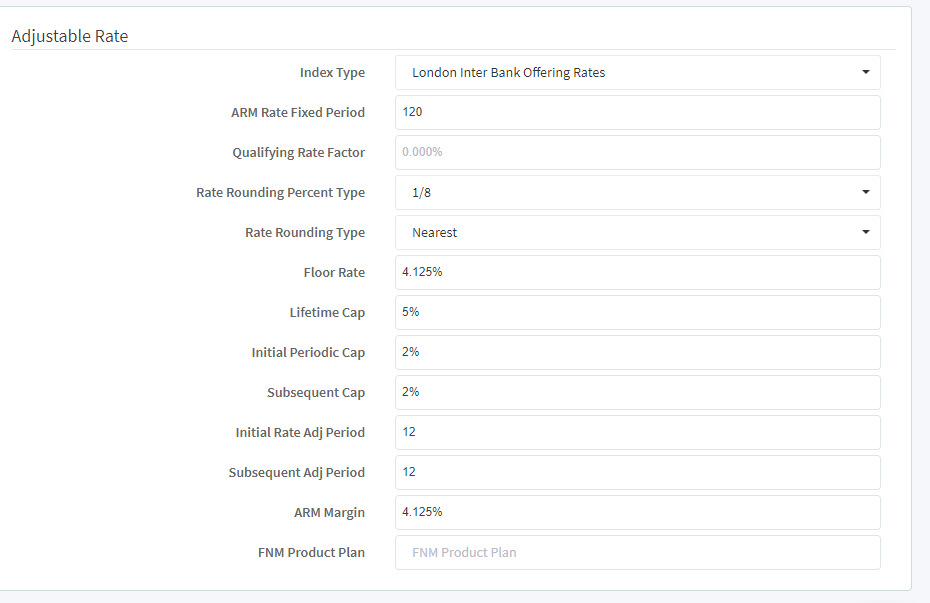

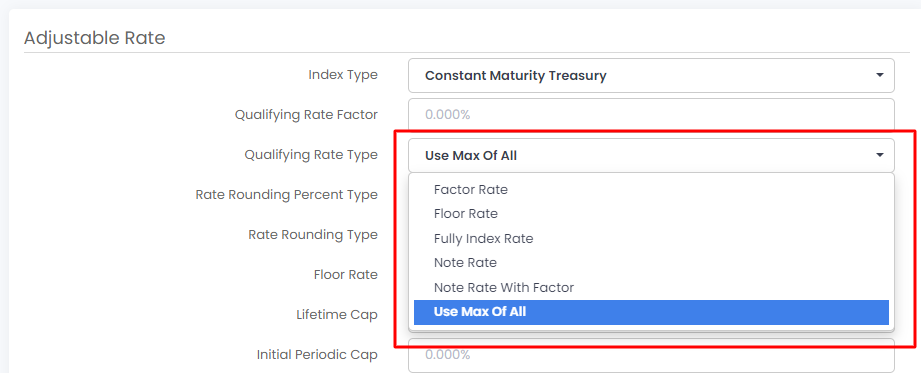

6. If you selected “Rate Type” as “Adjustable Rate”, Input all the required adjustable-rate information like Index, Arm rate, Caps, etc.

***As of 7/2 Partial Payment type, Qualify Payment Type, and Qualifying Rate Type options will be available in the program settings to further define program parameters****

- Active - indicates if the program is active and can be chosen on the loan files

- Forward mortgage - Used for calculating amortization. If a reverse mortgage toggle this off.

- Prepayment penalty - To indicate PPP on the loan. Users can go to the loan additional > Underwriting section to complete PPP fields

- Assumable - Indicates if the loan is assumable.

- Neg Amortization - Indicates if the loan has neg am or not.

- Manual Lock - allows users to manually enter lock data if on. If off, only a PPE will be able to complete lock data.

- Hedge - Used as an indicator for hedging

- Buydown - Used to structure buydowns in the loan additional > buydown section.

- Balloon - Used to indicate if the loan has a balloon.

- Loan Affordable - Used for loans such as home ready or home possible

- Open ended - used to indicate open ended mortgages.

- ARM - Generic ARM plan codes can be found below. For specific ARM plans see this link